Credit Health Report

Get Expert Insights into your Credit Health & Unlock your Full Credit Potential

Whatever be your current credit ratings, our Credit Health Report (CHR) can help you unlock your credit potential. As our tagline goes, Credit Healthy Toh Credit Wealthy. So, start working on your credit health with our Credit Health Report.

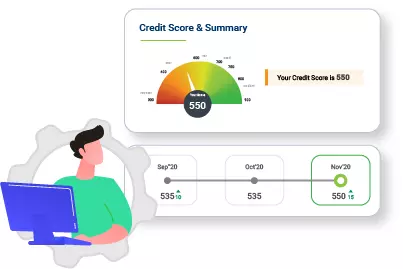

Know your Number – Access your latest credit score for free anytime, understand where you stand, and track your score over time.

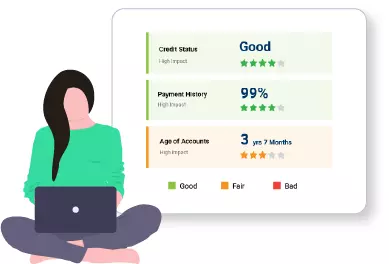

Credit Score Summary -Identify the factors influencing your score and get an easy-to-read and easy-to-understand summary of your credit report.

Expert Guidance and Tips – Make your credit score your friend and not a foe with our credit health insights. We help you unlock your full credit potential with expert tips and actionable insights.

Learn how to Maintain or Improve your Credit Score – We offer in-depth account level analysis to provide you with tips on how to improve or maintain your credit score.

Best Credit Products Matched to your Credit Profile – Our data-driven tool pulls information from your credit report to match you with the best loans and credit cards suited to your credit profile.

Avoid Multiple Loan Applications – Get the best loan offers at your fingertips. Evaluate and choose the right one. Simplify your credit search.

Get Monthly Updates – Keep a pulse on your credit score and credit health with our detailed monthly reports.

Track your Progress – See how your credit efforts are impacting your credit score.

Stay on Track with your Credit Payments – Easily check for missed/delayed loan EMIs, credit card bills

Identify Frauds/Errors – your credit report for errors, account misuse and frauds. Learn how to rectify them and update your credit report.

Spending Pattern – Track and monitor your expenditures week-on-week in different categories.

Spends Analyser – Analyse your spending habits and handle your budgets better.

Gain access to an intuitive dashboard that provides real-time insights into your credit health. Track your credit score, monitor changes, and understand how your financial actions impact your credit profile.

Our dedicated financial experts work closely with you to analyze your credit history and create a personalized strategy to boost your credit score and improve your financial standing.

We value your trust. Our guidance is clear, unbiased, and tailored to your unique financial situation. No false promises – just genuine support on your journey to financial freedom.

At GrowScore, we leverage cutting-edge technology and data analysis to understand your financial potential. Our proven approach has empowered countless individuals to take control of their credit and secure easy access to loans.

Our Financial Health Report goes beyond just showing your credit score. It provides a detailed analysis of your financial potential, spending patterns, and personalized recommendations to improve your creditworthiness. It helps you better understand your financial standing and offers insights for easy access to loans.

Your Financial Health Report is updated every month. However, you can log in to your dashboard anytime to view or download the latest report or any previous reports.

Credit score improvement depends on your financial situation. On average, our customers start seeing positive changes in 4 to 6 months with consistent efforts and timely payments.

Yes, absolutely. We prioritize data security and use 128-bit or higher encryption to ensure your information is secure. Your data is protected at every step of the process.

While we cannot guarantee a specific increase in your credit score, our expert guidance and credit improvement strategies significantly increase the chances of improving your credit profile over time.